During the holidays’ people decide on their New Year’s resolutions. Most of which have been the same for the last few years. And very few people add to that list; to organize your finances. Right?

Let’s start this year differently because, without a plan, we will end the year with the same goals and dreams unfinished.

Starting to organize your finances is the first step.

Whether you are starting over after sequestration, you are paying off debt, or you simply want a better understanding of your financial situation.

Organizing your finances can feel overwhelming and scary, but it is the best way to start managing your money effectively. And you have the possibility of reaching your financial goals.

Here are 6 tips to help you get started on organizing your finances:

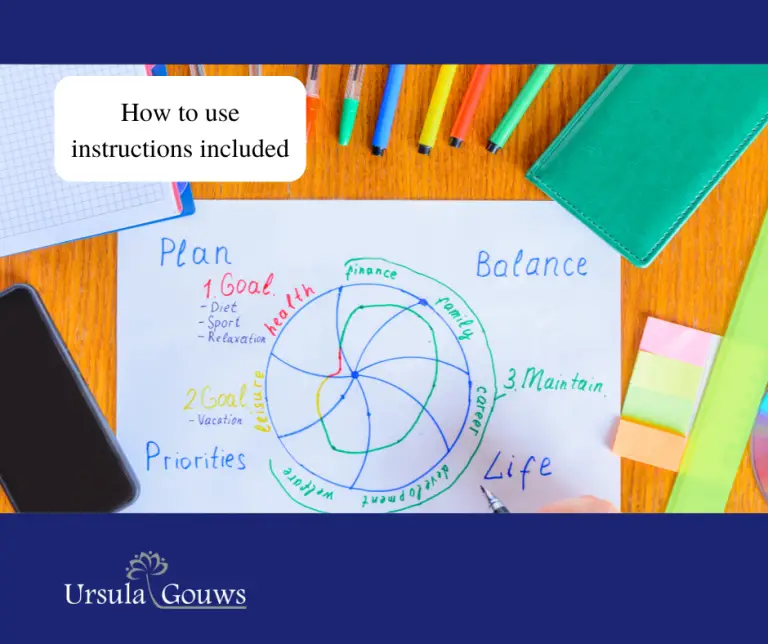

1. Set financial goals

- To help you stay motivated and focused.

- To help you stay on track and make better financial decisions.

- Be specific with your goals and give yourself a timeline to achieve them.

- Take some time each month to reflect on your financial goals and how you can work towards achieving them

2. Create a budget

- To help you track how much money you have coming in and going out.

- To create a budget, start by listing your income sources and expenses.

- Once you have a complete list, subtract your expenses from your income to see how much you have left over. If you are spending more than you are earning, you will need to find ways to reduce your expenses or increase your income.

- Review your budget each month. Make sure you are on track and adjust it as needed.

3. Track your spending

- Track your spending for a few months to better understand your spending habits.

- This can help you identify areas where you may be overspending and places where you can cut back.

- You can track your spending using a budgeting app, a spreadsheet, or simply by writing down everything you spend in a notebook.

4. Set up a savings plan

- Having some money set aside for emergencies and future goals is important.

- Consider setting up a savings account and automating regular debit orders from your bank account.

- This can help you build up your savings without thinking about it.

5. Check your credit report

- Review your credit report at least once a year to ensure everything is accurate and to catch any potential issues early on.

6. Consider using financial planning tools

- Many online financial planning tools can help you manage your money more effectively.

- There are budgeting apps, investment platforms, and financial planning software.

Organizing your finances may seem like a daunting task, but it is an essential step in managing your money effectively and achieving your financial goals.

By following these tips, you can take control of your finances and set yourself up for financial success.

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.