Living with a plan and personal finance planning is essential if we have learned one thing from the past few years of economic crisis.

Most of us are constantly one personal crisis away from disaster because we tend to put off tasks that need to be completed immediately until tomorrow.

No one wants to be here, but there are a lot of us who are. And living with a plan and planning your personal finances is essential.

We must set aside time regularly to evaluate our financial or life plans. Maybe even go back to the drawing board as circumstances change in our lives and establish our proprieties again.

Despite all the noise on the outside, are you living according to a plan with goals in each area of your life?

My Story of starting to live with a plan

When I was putting my life back together after my second Sequestration, I lived almost day to day. I needed a plan for that day. Either I needed money for food or fuel for a meeting.

Then as my situation got better financially, the plan was for a week, then a month.

It took me years of planning my finances before I could even consider the year ahead.

If there is one thing we can take away from the past few years, personal financial planning is crucial.

Do you have a financial plan or life plan?

Or are you winging it like most people?

Here are some questions to ask yourself –

- Do you want to be a good parent, wife, or husband?

- A good employee or business owner?

- Go on holiday this year?

- Move to a new country, town, or area?

- Change your financial position?

What is your plan, and what are your goals?

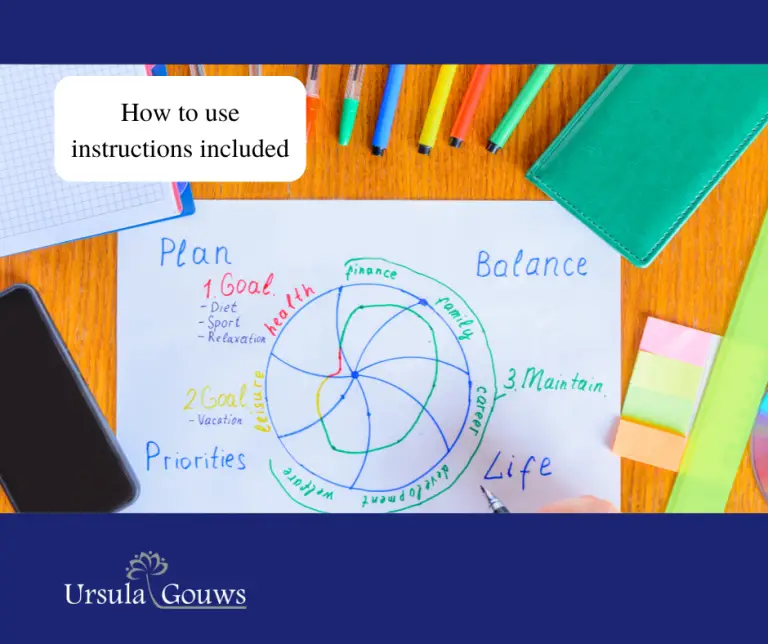

Here are some simple steps for setting a simple plan for your life or personal finances.

Step 1

Sit down and write out your financial or life plan.

I love colored paper and glitter pens. Go wild, or maybe, for now, start with a simple black pen on white paper.

Take the picture in your head and give it life on paper.

For many people, this exercise can be challenging. We are tired of keeping our budget together every month, knowing prices are going up, and we don’t know if this will end.

Push past your fears and start with just one idea.

And have an honest look at where you are going.

Ask some serious questions.

- Am I in my 20’s and want to study?

- Do I want to get married?

- Are you maybe divorced?

- Do we want to start a family?

- Are the kids going to school? Primary, High, or University?

- What about a holiday, local or maybe overseas?

- Do I have too much debt and need a repayment plan?

When you have your ideas or goals on paper, they start to get more organized, and a plan begins to form.

This plan becomes the foundation of a new direction in your life.

Step 2

Break each goal down into several short-term (less than 1 year), medium-term (1 to 3 years), and long-term (5 years or more) goals.

Remember that you can plan for a day, a week, or a month if a year seems too big.

Step 3

Educate yourself. Read magazines or books, or surf the Internet.

With a little effort, you can learn enough about anything.

You can make educated decisions that will increase your knowledge and bring you closer to your plan.

Then identify small, measurable steps you can take to achieve these goals, and put this action plan to work.

Step 4

Now you need to evaluate your progress.

We usually write down a plan and then throw it in the cupboard.

Review your progress monthly, quarterly, or any other interval you feel comfortable with, but at least semi-annually, to see if your plan is working.

If you’re not making satisfactory progress on a particular goal, re-evaluate your approach and make changes as necessary.

DO IT NOW!

There are no hard and fast rules for implementing a financial or life plan.

The only necessary step is to do SOMETHING and to start NOW.

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.