Personal Sequestration in South Africa

Are you ready to stop the financial stress and start over?

When your personal finances collapse, it is not the end.

It is your turning point.

You have tried everything, borrowed, negotiated, cut back, and held on.

Hoping things would get better.

But sometimes, despite every sacrifice and sleepless night, the numbers don’t add up.

The pressure builds. Creditors call. You stop answering the phone because every ring feels like another judgment.

And the guilt and shame start eating away at your confidence.

Here is the truth no one tells you: you are not a failure for being in debt.

You are human, and life can hit hard: illness, divorce, retrenchment, or bad business luck.

Sequestration is not the end of your financial story.

This is the opportunity to start over. A legal, structured way to start over without hiding, lying, or drowning in endless repayments.

This is not a weakness. It is courage. It is a kind of reset that stops the chaos, clears the slate, and gives you your life back.

How Personal Sequestration Works in South Africa

Personal Sequestration is governed by the Insolvency Act 24 of 1936 and provides a High Court-approved legal order that permanently clears your debt and gives you a legal path to rebuild your financial life.

It is the only legal process in South Africa that can fully write off qualifying debt. Not reduce it, not consolidate it, but legally erase it through a High Court order.

This process exists for individuals who are no longer able to meet their financial obligations. This situation occurs when your liabilities exceed assets, and individuals have no realistic means to repay their creditors.

In these circumstances, the law recognises your position as insolvent and provides a legitimate, transparent solution.

Personal Sequestration is not about avoiding responsibility.

It is about using the law as it was intended: to protect honest individuals who have tried everything and deserve a fair, legal second chance.

Sequestration - With or Without Assets

Personal Sequestration is a legal High Court process, and every application must meet strict requirements.

Whether you have assets or not, the court must still see a benefit to your creditors.

Here is how each option works and what the law expects.

A Sequestration Court Order can only be granted by the High Court and is therefore NOT a Free Application.

One of the objectives for Sequestration is that the process needs to advantage your creditors.

In other words, the creditors must recieve something back from the finances that they loaned to you.

You can apply for Sequestration with an asset.

The asset will be sold by the Trustee in the estate to settle the creditors.

Please do not be scammed by people saying you can keep your asset during a Sequestration.

The bank will not allow it.

Or worse, please do not hide assets from us. The Trustee will trace them, and you will still lose them in the process.

You can also apply for Sequestration if you do not have an asset.

This monthly installment or the legal term is the advantage to the crditors is calculated according to your personal debt situation.

Please note - There is no “one size fits all” for the cost of any Sequestration application.

Who can apply?

- You have an income or other means of funding the legal process.

- You are over-indebted and unable to pay your creditors on time or meet your financial obligations.

- One or more of your accounts are in arrears or under pressure.

- You are willing and able to commit to a formal High Court legal process.

Why declare yourself insolvent?

- Debt repayments have become unmanageable.

- A debt amount is outstanding from an asset that was repossessed or autioned.

- A substantial amount of debt was incurred, that will take more than 5 years to pay back (excluding your home loan).

- Creditor pressure is relentless and ongoing.

- Assets or income are no longer sufficient to recover financially.

- Other debt relief options are no longer viable.

- You cannot afford your asset (Home or Vehicle) and are willing to lose it.

Is Personal Sequestration the right option for you?

Every legal debt solution has strengths and limitations. Sequestration is no different.

Personal Sequestration is a legal High Court process, not a loophole.

The truth is simple: the limitations are temporary, but the relief is permanent.

Sequestration exists to give honest people a lawful reset when debt has taken over, and there is no other way out.

If you are overwhelmed and unable to keep up.

Sequestration offers absolute legal protection, real financial stability, and a clear path forward.

Understanding the benefits and risks will help you make an informed, confident decision.

Advantages of Sequestration

Here are the advantages of the legal process:

- 1. Your income becomes your own again. Once we start the sequestration process, you stop paying your creditors. Full stop. You are no longer juggling bills or trying to decide who gets paid this month. From this point on, your income is yours to rebuild your life.

- 2. Your creditors are notified, but your employer is not. The process is confidential. We will notify all known creditors, but you don't have to tell your boss, your coworkers, or your family. No one else needs to know unless you choose to tell them.

- 3. Your debts are written off for good. Once the sequestration court order is granted, you are no longer legally responsible for your debts. You walk away with a clean slate. No debt collectors, no court threats, no more sleepless nights.

- 4. All repossessions and auctions are stopped. When we advertise your voluntary surrender in the Government Gazette and local paper, any legal action or repossession against you must stop. That means your creditors can't sell your assets or drag you through court anymore.

- 5. It is a legal, structured, and final solution. This process is not a loophole. It is protected by law and approved by the High Court, and it exists to help honest people recover with dignity.

Disadvantages of Sequestration

Here are the disadvantages you need to consider:

- 1. You won't be able to get credit. Once you are sequestrated, you can't apply for loans, credit cards, or store accounts until you are officially rehabilitated. That is the point of this process — to reset your finances without falling back into the same debt trap.

- 2. You can't be a company director. While sequestrated, you are not allowed to be a company's registered director. If you already are, you must step down during the process. Once you are rehabilitated, this restriction falls away.

- 3. You will lose your bonded property. If you own a home with a bond, it will form part of the estate handed over to the Trustee. The sale of the property is used to help settle your debt. This loss will be emotional, but it is part of what clears your name legally.

- 4. You will lose your vehicle if it is financed. If your car is financed through the bank (Hire Purchase), it will also be included in the sequestration. Fully paid-off vehicles may be protected, depending on your situation.

- 5. You can't own assets until you are rehabilitated. Any new assets you acquire are technically part of your insolvent estate during sequestration. Once you are rehabilitated, you are free to own assets again — including a car, home, or business.

- 6. Your bank accounts will be limited to a savings account. You may not have a cheque account or a credit card facility. You may under no circumstances engage in any debt arrangements.

with a Legal High Court Order. There will be no debt to worry about. And we are here to walk you through it.

Is personal Sequestration the right legal option in your situation?

YES, you should Sequestrate

- You can’t afford your debt every month.

- The bank has auctioned your house, and there is a shortfall.

- The bank has repossessed your car, and there is a shortfall.

- Your business failed, and your current salary is taken up with repayments.

- You were without work for some time, and now you are playing catch up.

- You got divorced and were left with the debt (yes, it happens to both men and women).

- You are in arrears at SARS.

- You are paying debt older than 3 years.

- You are under Debt Review, and the debt is not decreasing.

MAYBE, you should Sequestrate

- You cannot afford your vehicle, or the bank will repossess your vehicle soon.

- You cannot afford your bond payment, or our property is going up for auction.

NO, you should probably NOT Sequestrate

- You have a vehicle on Hire Purchase (HP) at the bank, and it is your only form of transport.

- You have an outstanding bond, and you have no other means of accommodation.

Questions People Often Ask About Personal Sequestration

You can apply to the High Court to voluntarily sequestrate your estate.

Alternatively, a creditor can apply to the court for Sequestration if you are unable to pay your debts.

The smart move is choosing the route that best protects you.

I will tell you straight which option fits your situation and walk you through it without the legal jargon.

When you are sequestrated, your legal estate is handed over to the Master of the High Court.

Then a Trustee takes control. That might sound scary.

But it is simply the legal way your debt gets dealt with.

So you can stop drowning in debt and wipe the slate.

While rebuilding your financial stability without creditors harassing you.

Yes! When the High Court grants the Sequestration order, creditors must stop all legal action. And you stop paying them.

The debt only falls away officially at Rehabilitation. But the financial relief starts immediately. The debt usually stays in your name at the credit bureaus during the Sequestration process to prevent the banks from granting you credit.

Yes! If your home or car is financed, it forms part of the insolvent estate and will go back to the bank.

If your car is fully paid off, you can usually keep it, but part of its value goes toward your creditors.

If the car is financed in someone else’s name and you keep paying, you keep the car.

If your furniture is paid off, you keep it.

Only those items may be reclaimed by the creditor if it is still financed.

Paid-off household goods may be valued as part of the estate, but you keep them and pay the agreed value off monthly. No one is coming to empty your home.

Yes! Your pension and retirement annuity are protected by law. The policies don’t form part of the Sequestration and they stay safely in your name.

You may only use a savings account until you are rehabilitated. You are not allowed to access credit facilities, overdrafts, and debt.

Yes! You can move from Debt Review/Counselling to Sequestration if Debt Review isn’t working for you. Many people do.

Not usually. The court must see a financial benefit for creditors. If you can’t contribute anything, the Squestration won’t be approved.

Unfortunately, there are no legal options for debt relief if you are unemployed and cannot contribute to creditors' payments.

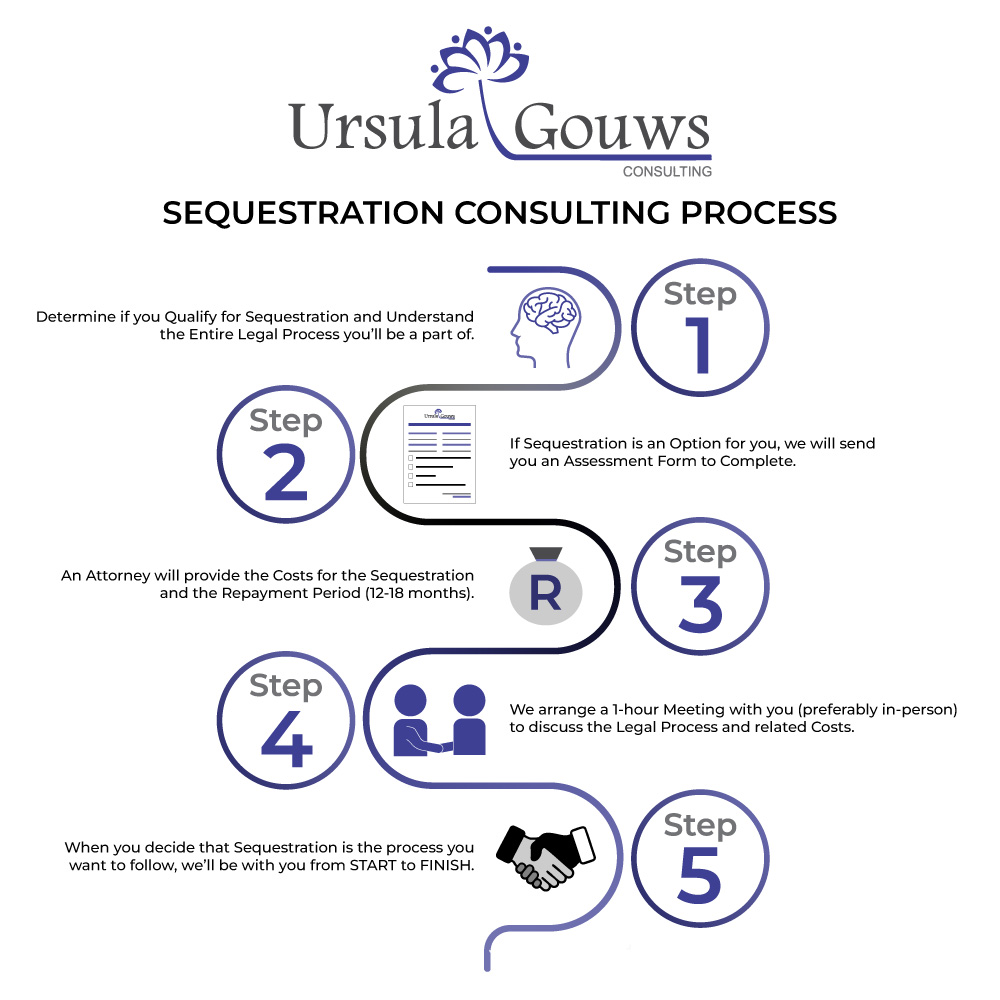

What to expect from Our Sequestration Consulting process

We get to know each other. To determine whether you qualify for Sequestration (with or without an asset), we will first ask you several questions to understand your financial situation.

We need to thoroughly understand your unique situation and needs as you consider applying for Sequestration.

It is also essential that you fully understand the entire legal process in which you will be involved.

If Sequestration is an option for you.

We will send you a Free Assessment form to complete.

The assessment provides us more information on your debt situation to develop a comprehensive plan and start to discuss costs and affordability.

Our attorney will provide the costs for the Sequestration and the repayment period.

The repayment term could be 12 to 18 months in affordable monthly payments.

We will set up a meeting with you to discuss the legal process and costs.

We prefer to meet our clients in person, and if you can travel to our offices in Centurion, we will set up a meeting that will last roughly an hour.

If it is not possible for you to attend a meeting at our offices, we will set up a telephone call or use an online platform.

During our meeting, the Sequestration legal process, applicable to your individual situation, will be explained to you, as well as the payment plan that we can help you with.

When you decide that Personal Sequestration is the process you want to follow.

Ursula Gouws and her team will be with you from start to finish.

To support you and ensure your legal process is completed with clear and transparent communication

How the personal Sequestration Legal Process works

An advert is published in the Government Gazette that will prevent any legal action from being taken against you.

The High Court will then set a court date for you.

The Insolvency Act 24 of 1936 protects you once the advertisement appears.

All legal application documentation will be handled by the attorney.

You are required to sign all documents before a Commissioner of Oaths.

Statements must be submitted for inspection at the Master of the High Court and the local Magistrate’s Court for 14 days.

Your creditors will be informed of the surrender of your estate via registered mail.

SARS will also be notified.

When the High Court hears your case, an Advocate will represent you.

You do not need to appear in court.

Once the High Court has approved and granted your application, a Curator/Trustee is appointed to handle all the financial matters concerning the Sequestration, and the credit settlement process starts.

The settlement process can take anywhere from a couple of months to years.

Once all creditors’ claims have been settled, the Curator/Trustee will provide an L&D account stating that the insolvent estate has been satisfactorily concluded.

You may then apply for Rehabilitation.

When do you qualify for Rehabilitation?

We can attend to your Sequestration Rehabilitation if you have been under Sequestration for at least 2 (two) to 4 (four) years.

Rehabilitation is the legal process for a person who has been sequestrated to be fully restored to the financial marketplace.

You regain control over every aspect of your finances.

As soon as you rehabilitate, the adverse credit information (about the debt incurred before Sequestration) is removed from the Credit Bureau, and your status will be changed from Sequestrated to Rehabilitated.

The Rehabilitation status will indicate on the Credit Bureau for the next 5 years that a notice of your Sequestration Rehabilitation was received.

The Ursula Gouws Consulting team has assisted and supported thousands of individuals and businesses through this difficult time, helping them achieve financial stability.

Disclaimer

Ursula Gouws Consulting assists with only legal debt relief solutions in South Africa, including Personal Sequestration, Business Liquidation, and Debt Counselling. We are not lenders or providers of credit. All services are offered in compliance with the National Credit Act (NCA) and South African Insolvency Law. Results vary depending on individual circumstances.