Using the Debt Snowball method to pay off your debt can be an effective strategy. Reading this blog post, find out more about using the Debt Snowball method to pay off the debt.

Debt can be an overwhelming and stressful experience.

It is simple to believe that you will always be in debt, and it can seem hard to even begin to reduce the amount you owe.

But there is hope.

You can create a Debt Snowball strategy to help you achieve your financial goals with time and effort.

A Freebie is available on my website to start your own Debt Snowball Tracker. There are How to Use Instructions included in the download.

What Is The Debt Snowball Method?

The snowball method is a debt reduction technique where you pay off each debt separately. Starting with the smallest balance and working your way up to the largest balance last.

This method works by having you focus all of your attention on one debt at a time.

Rather than spreading out payments across multiple debts. Which can make it harder to understand exactly how much you owe. Or keep track of when payments are due.

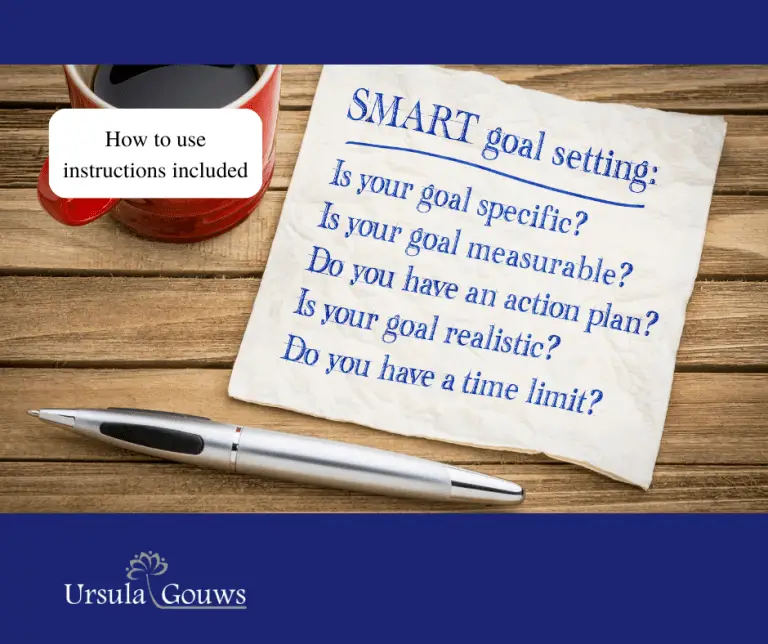

Here are steps you can take to pay off your debt using the Debt Snowball Method

- Gather all of your current debt information. Including the creditor, current balance, minimum monthly payment, and interest rate for each debt.

- Organize your debts from smallest to largest balance. Regardless of the interest rate.

- Make the minimum monthly payment on all of your debts except for the one with the smallest balance.

- Apply any extra money you have each month towards paying off the debt with the smallest balance.

- Once this debt is paid off, move on to the next smallest debt.

- Continue making the minimum payments on all of your debts, and apply any extra money towards the next debt on your list until it is paid off.

- Repeat the process until all of your debts are paid off.

- Track your progress by keeping records of your payments and the remaining balance of each debt.

- As you pay off each debt, you will have more money to apply toward the next one, creating a snowball effect.

It is important to note that this strategy involves staying current on all your other debts while making additional payments toward one specific debt at a time. Not just paying off one account while neglecting all others.

By doing this, you will not only make progress towards becoming debt-free but also avoid hurting your credit score by missing payments or getting late fees associated with any of your accounts.

It’s also important to note that this method is not always the most efficient.

You may want to look into other methods, such as the Debt Avalanche Method, where you first tackle the debt with the highest interest rate to pay less overall interest.

Conclusion

The Snowball Method is an effective way to pay down your debts without feeling overwhelmed or discouraged by how much money you owe.

By tackling each debt separately and focusing all your energy and resources on one at a time, you can quickly get back into financial shape without stressing yourself out or risking damage to your credit score from missed or late payments.

So if you are looking for an efficient way to pay off what you owe and improve your financial situation, consider giving the Snowball Method a try.

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.