Saving money is a great way to ensure you have the financial resources you need in an emergency, unexpected expenses, or to prepare for the future.

Knowing where to start when trying to save money can be difficult.

This blog post will provide helpful tips for saving money and improving your finances.

Step 1

The first step in saving is determining how much you can set aside each month.

Take a look at your income and expenses and see what amount of money you can comfortably set aside for savings.

Consider cutting unnecessary costs to free up more money for saving if possible.

Additionally, look for ways to save on your everyday expenses by shopping around for the best prices on groceries and other essentials.

Step 2

The next step is setting up a savings account at a bank that offers competitive interest rates.

This allows your savings to grow over time while still being accessible if needed in an emergency.

You should also consider setting up automatic monthly transfers from your main account into your savings account. So that saving becomes part of your routine without requiring extra effort from you.

Step 3

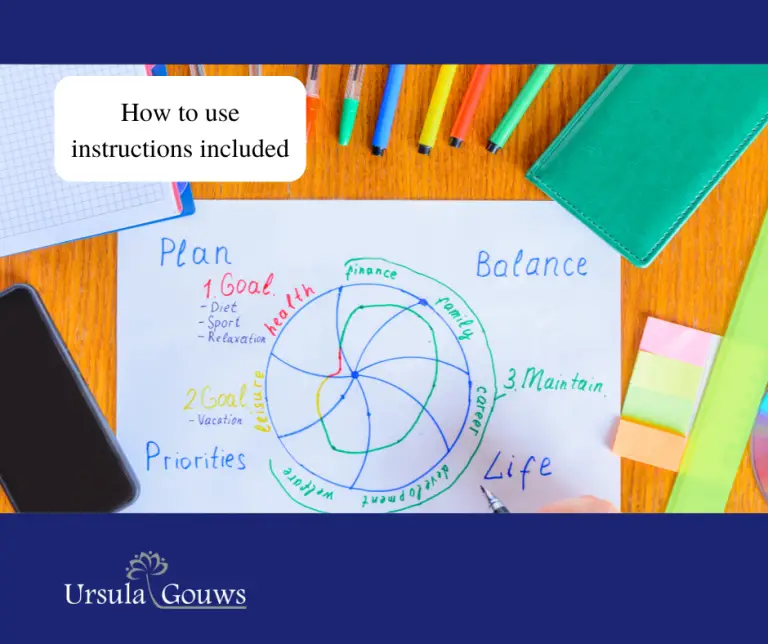

Finally, it is important to establish financial goals to stay motivated while saving.

Setting long-term goals, such as buying a home or paying off debt, can help keep you focused on the big picture. Even during times when it feels like money is tight and there is not enough left over for saving.

On the other hand, setting short-term goals like taking a vacation or updating your wardrobe can give you something specific to work towards.

While helping break down large financial goals into more achievable steps.

Conclusion

Starting a savings plan does not have to be overwhelming.

All it takes is some planning, discipline, and time to set realistic goals. And make small changes in your spending habits.

This will pay off in the long run as you build up financial security for yourself and your family.

So take some time today to assess where you are with your finances.

Create a budget.

Research different types of savings accounts.

Set up automatic transfers from your bank account into a saving account

And decide which financial goals are most important for you right now—you won’t regret it.

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.