A Debt Free Christmas Tracker is a tool used to help you stay organized and on track to achieving your goal of a Debt Free Christmas.

The holiday season is a wonderful time of year – but it can also be stressful.

The thought of buying presents and hosting parties can be overwhelming if you are already in debt.

You might wonder how you will ever manage to pay off your existing debts while still enjoying the festive season.

Don’t worry. There are ways to plan a Debt-Free Christmas that won’t leave you feeling the pinch.

You can have a merry Christmas without debt with thoughtful planning, creativity, and budgeting savvy.

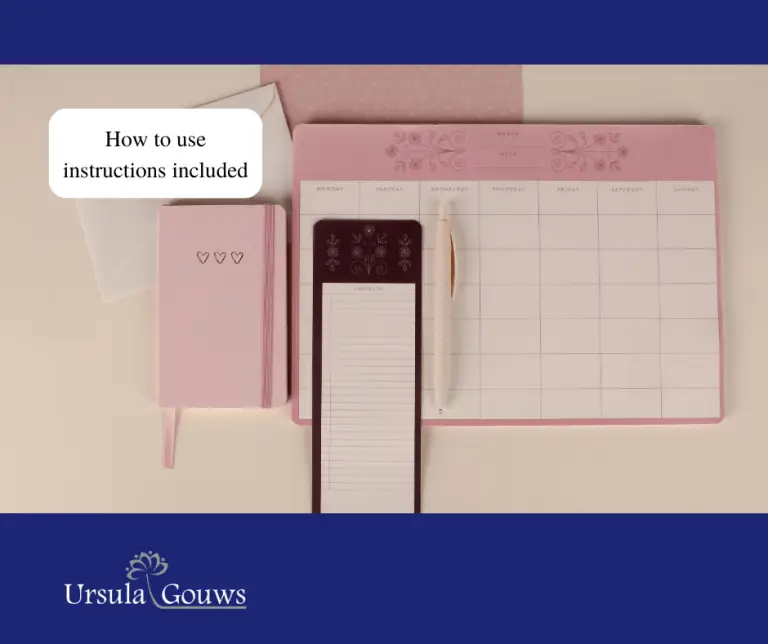

A Freebie is available on my website to make your own Debt Free Christmas Tracker. There are How to Use Instructions included in the download.

Here are some steps to a Debt Free Christmas

Set Your Budget Early On

Creating a budget should always be your first step when preparing for any spending, especially if you know that money is tight.

Start by writing down all of your income sources as well as all necessary expenses like rent, food, and utilities.

Then, determine how much money is left over for fun activities like gifts and decorations – this will be your Christmas budget!

Once you have an amount in mind, stick to it!

It’s important that you don’t overspend or go into debt during this special time of year; doing so could cause more financial hardship than necessary down the line.

Shop Smart

Once your budget is set, it is time to start shopping!

Look for deals online or at local stores to save money on gifts.

Try shopping around for discounts on items like electronics or clothing – sometimes, stores offer great prices during the holiday season that you would not find any other time of year.

Also, consider homemade gifts instead of store-bought items; they can often make just as meaningful presents while costing much less.

Finally, take advantage of free delivery offers when available; this will help cut costs even further.

Save Throughout The Year

Saving throughout the year is another great way to avoid spending too much during Christmas.

Open up a separate savings account dedicated solely to Christmas spending. Each month add what you can spare from your budget into this account.

When December rolls around, you will have enough saved up for all your festive needs.

This strategy works especially well if you split up big expenses, like presents, into smaller amounts throughout the year.

That way, when December finally arrives, you won’t feel overwhelmed by having to shell out large chunks of cash at once.

If possible, try putting away extra money whenever possible– every little bit counts.

Conclusion

Planning a Debt-Free Christmas doesn’t have to be difficult or expensive. With careful planning and savvy shopping strategies, anyone can enjoy their holidays. Without going into debt or feeling overwhelmed by expenses.

Start by setting yourself a realistic budget early on and stick to it no matter what.

Then shop around for discounts, and free shipping offers whenever possible– these small steps will add up quickly and save you lots of money in the long run.

Remember that saving for Christmas is a long-term process. Also, don’t forget to be realistic about your budget and what you can afford. It is always better to celebrate within your means rather than go into debt.

Finally, don’t forget about saving throughout the year. This strategy ensures that when December rolls around, all your holiday needs are taken care of without too much stress about finances!

So start planning now – happy holidays, everyone!

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.