Business Liquidation in South Africa

You have done everything you could. Now it is time to look at your options.

When your company can’t keep up, it is time to cut your losses — not your worth.

Running a business in South Africa is not for the faint of heart. You push, sacrifice, and believe things will turn around — because that is what good business owners do.

But sometimes, things don’t get better.

Between economic downturns, lockdown aftershocks, cash flow gaps, and rising costs, your business can end up with more debt than it can handle. Salaries fall behind. VAT piles up.

You start covering shortfalls from your personal pocket — until that runs dry, too.

Here is the truth no one wants to say out loud:

Throwing more of yourself at the problem won’t fix it.

Liquidation may be the smartest, most strategic move you can make when your company is drowning in debt and there is no realistic way to recover.

This is not failure. It is you choosing to protect yourself, stop the bleeding, and move forward with integrity.

how business liquidation works in South Africa

Business Liquidation is governed by the Insolvency Act 24 of 1936 and is the legal way to shut down a business that can’t pay its debts before it destroys you personally.

The legal process in which a business, whether a PTY LTD or a close corporation (CC), is officially closed down because it can’t pay its debts.

Once the Business Liquidation process begins, creditors are blocked from pursuing the company’s assets.

This means no more phone calls, lawsuits, or sheriffs knocking on your door for business-related debts.

The legal process can be voluntary (you choose to apply), forced (by a creditor or SARS), or negotiated.

Making the wrong move before Business Liquidation, such as hiding assets or paying one creditor ahead of others, might be challenged by the court or creditors.

Here is what matters most:

Your business is a separate legal entity.

This means, in most cases, you are NOT personally liable for the business debt unless you have signed a personal surety or guarantee.

Business Liquidation also includes SARS debt.

If you are uncertain about the timing of Business Liquidation, don’t make assumptions.

At the end of the legal process, the business is closed.

Business Liquidation: with or without Assets

Business Liquidation is a formal legal process under the Companies Act, and every application must meet strict requirements.

Whether your business has assets or not, the process must still see a lawful benefit to creditors before a liquidation order can be granted.

Here is how each option works and what the law expects.

A Liquidation Order is a legal process and is therefore NOT a Free Application.

In other words, the creditors must get something back for the finances that they loaned to you.

You can apply for Liquidation with an asset.

The asset will be sold by the Trustee in the estate to settle the creditors.

Please do not be scammed by people saying you can keep your asset during a Liquidation.

The bank will not allow it.

Or worse, please do not hide assets from us. The Trustee will trace them, and you will still lose them in the process.

You can also apply for Liquidation if there are no assets in the business.

This payment or the legal term is the advantage to the crditors is calculated according to the business debt situation.

Please note - There is no “one size fits all” for the cost of any Business Liquidation application.

When to apply for Liquidation?

Any business entity whose liabilities exceed its assets is usually described as being insolvent.

However, the legal test for insolvency is whether the debtor can pay their debts on time.

The usual route for Business Liquidation is a court application, but this can be time-consuming and expensive.

When 75% of the shareholders of a business, or all the members of a close corporation, agree that the business should be liquidated, there is the option of a voluntary Business Liquidation.

This route provides a quicker, less costly, and less messy way to voluntarily liquidate a company or close corporation (CC). This also means you can get a Liquidation order and a liquidator appointed much more quickly and easily than going through the courts.

Voluntary Business Liquidation is the fastest way to get a company out of debt.

Consultation with us is strongly advised beforehand to assess the company’s condition as it stands today, so that we may provide the best advice and guidance in all matters.

We can help you

- Have immediate financial relief at the end of the month.

- Provide protection from creditors or SARS taking legal action.

- You will not appear in Court at any time during this process.

- You will drive your bank-financed vehicle for a time before it is sold.

Rehabilitation / Withdrawal

- There is no rehabilitation or withdrawal process as the business has ceased to operate at the beginning of the process.

Understanding the Advantages and Disadvantages of Business Liquidation

Every business debt solution has strengths and limitations.

Business liquidation is no different; understanding both sides will help you make an informed, confident decision for your company.

Advantages of Liquidation

Here are the advantages of the legal process:

- 1. All legal action and creditor pressure stop. Once the liquidation process begins, creditors can no longer take individual action against the company. The court-appointed liquidator takes control, and all matters are handled legally and fairly.

- 2. Directors are protected from further personal liability. When liquidation is done correctly, Directors stop trading while insolvent. Preventing personal exposure under the Companies Act. There is a legal line between the business debt and your personal assets.

- 3. Creditors are ensured of fair treatment. Liquidation follows strict legal procedures so that every creditor is paid according to their legal standing with full transparency.

- 4. Business closure and a clean financial break. If the business cannot recover, liquidation provides a legal end rather than ongoing losses, stress, and sleepless nights. It gives you the space to rebuild your financial future without dragging the past behind you.

- 5. It is a legal, structured, and final process. Business liquidation is not a loophole or a failure. It is a legal solution for closing a business responsibly and protecting directors from further damage.

Disadvantages of Liquidation

Here are the disadvantages you need to consider:

- 1. Control of the company is lost. Once liquidation starts, all authority transfers to the liquidator, who manages the company’s assets and affairs.

- 2. All company assets are sold. Everything registered to the business, property, vehicles, stock, and equipment becomes part of the insolvent estate to repay creditors.

- 3. Employees are retrenched. Employment contracts end when the liquidation is granted. However, employees are classified as preferential creditors and may claim outstanding salaries, leave pay, and UIF benefits.

- 4. Contracts and leases are cancelled. Supplier agreements, rental contracts, and service arrangements are usually terminated upon liquidation.

- 5. It may affect your credit and reputation. A liquidation is recorded with the CIPC and may affect your reputation with suppliers, lenders, and business partners. If you signed personal sureties on behalf of the business, those debts may still reflect on your personal credit record and could affect your creditworthiness.

Questions people often ask about Business liquidation

Yes.

Once the Business Liquidation order is granted, creditors cannot take further action against the business.

Debt includes summons, warrants of execution, garnishee orders under Section 65, and court orders.

All creditor claims must go through the liquidator, and the business cannot be pursued directly after liquidation.

Yes.

All assets owned by the business form part of the insolvent estate.

The liquidator takes control, values them, and sells them for the benefit of creditors.

On the date of liquidation, the business bank account is frozen and controlled by the liquidator.

No transactions may occur without their authority.

In most cases, No.

The business’s debts remain with the business.

However, you may be personally liable if you:

- signed personal surety,

- traded recklessly, or

- were involved in fraud.

The liquidator will advise if any personal liability applies.

Yes.

Once the Liquidation order is granted, all legal action against the business must stop.

Creditors are not permitted to pursue the company directly; they must deal with the liquidator instead.

Employees become preferent creditors in liquidation.

Outstanding salaries, leave pay, and UIF are handled through the liquidator’s distribution according to insolvency law.

Yes.

SARS becomes a preferent creditor.

The liquidator handles all SARS claims.

Liquidation does not prevent SARS from investigating compliance, but it does stop immediate enforcement action.

Yes.

You can start a new company.

Liquidation does not blacklist you or stop you from becoming a director in the future, unless there was proven fraud or mismanagement.

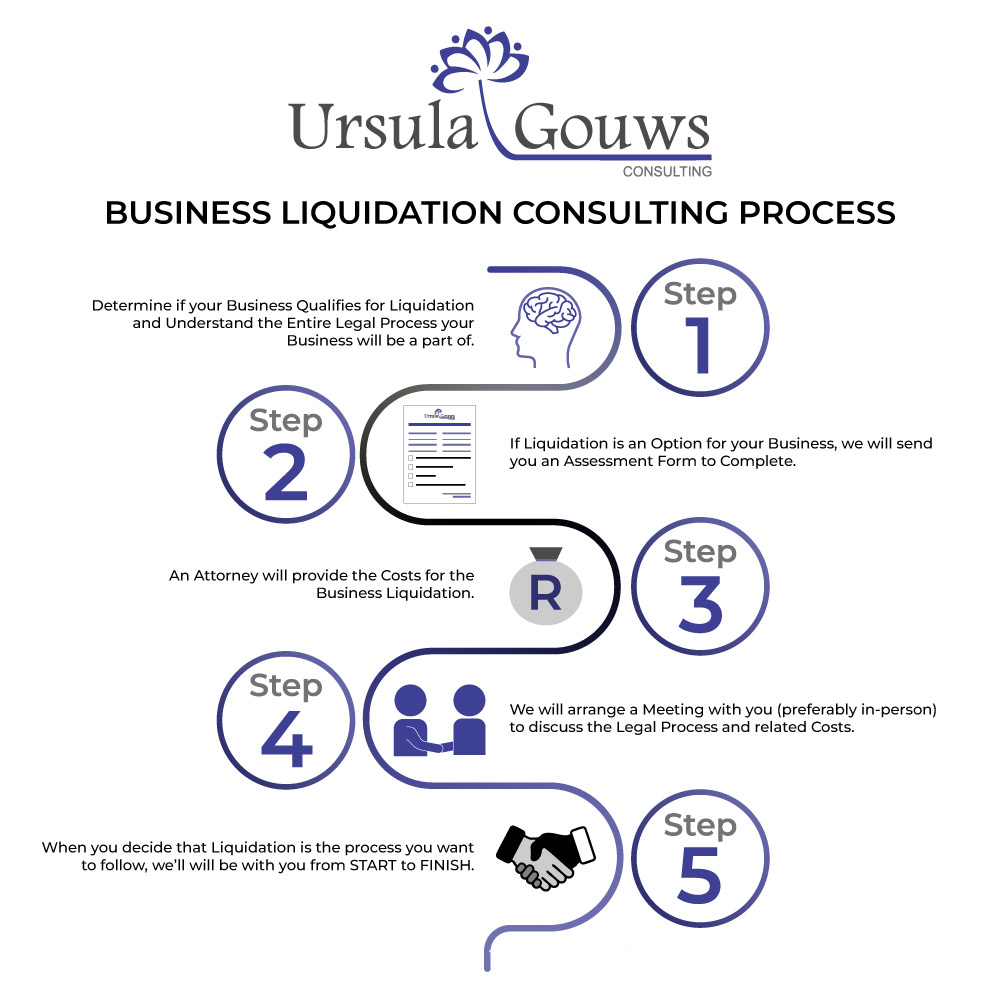

We get to know each other.

To determine whether your business will qualify for Business Liquidation, we will first ask you several questions to understand your financial situation.

We need to thoroughly understand your unique situation and needs as you consider applying for Liquidation.

It is also essential that you fully understand the entire legal process in which you will be involved.

If Business Liquidation is an option.

We will send you an Assessment document to complete.

The assessment provides us more information on your debt situation so we can provide a comprehensive plan and start to discuss costs and affordability.

A specialist attorney will assess your individual business situation and provide the costs for the Business Liquidation.

We will set up a meeting with you.

In the meeting we will discuss the legal process and costs.

We prefer to meet our clients in person, and if you can travel to our offices in Centurion, we will set up a meeting that will last roughly an hour.

It is important for us to fully understand your unique situation and needs as you consider applying for Business Liquidation. It is also important that you fully understand the entire process you will be a part of.

If it is not possible for you to attend a meeting at our offices, we will set up a telephone call or use an online platform.

During this meeting the Business Liquidation legal process, applicable to your individual situation, will be explained to you, as well as the payment plan that we can help you with.

When you decide that Business Liquidation is the process you want to follow.

Ursula Gouws and her team will be with you from start to finish.

To support you and ensure that your legal process is completed with clear and transparent communication.

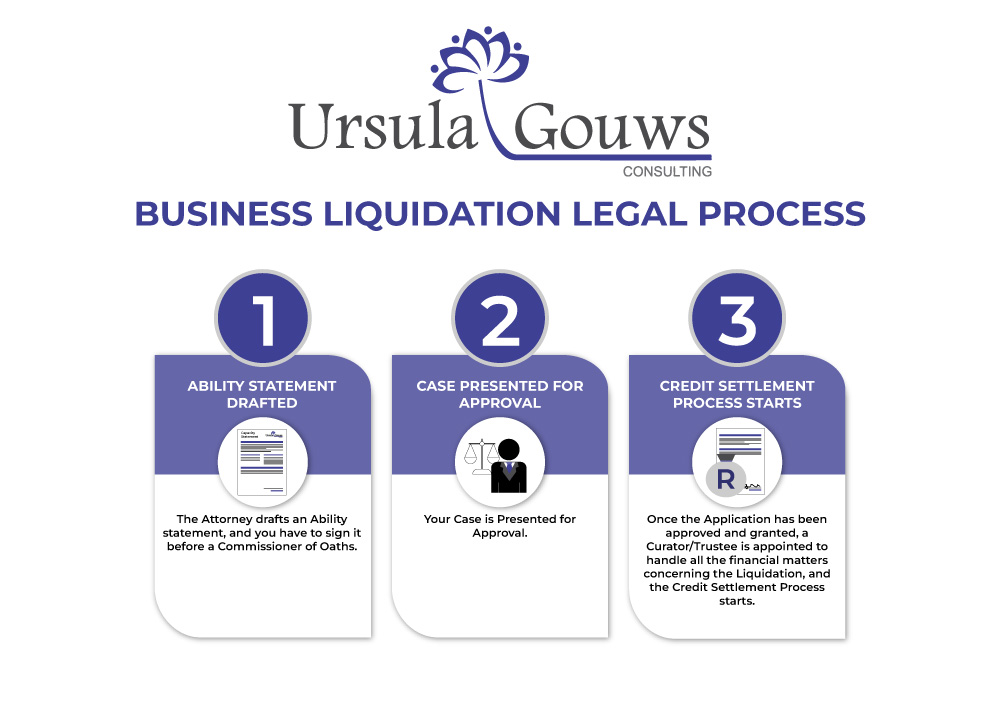

The Business Liquidation Legal Process

All legal application documentation will be handled by the attorney.

You are required to sign all documents before a Commissioner of Oath.

Your Business Liquidation application is presented for consideration and approval.

Once the Business Liquidation application has been approved and granted, a Curator/Trustee is appointed to handle all the financial matters concerning the Liquidation, and the credit settlement process starts.

Their tasks include:

- Ensuring all company contracts (including employee contracts) are completed, transferred or otherwise brought to an end, ceasing the company’s business

- Settling any legal disputes

- Selling any assets

- Collection of money owed to the company

- Distributing any funds to creditors and returning share capital to the shareholders (any surplus after repayment of all debts and share capital can be distributed to shareholders)

This legal process can take anywhere from a couple of months to many years.

Read about how the Ursula Gouws Consulting team has assisted and supported thousands of individuals and businesses through this difficult time and helped them achieve financial stability.

Disclaimer

Ursula Gouws Consulting assists with only legal debt relief solutions in South Africa, including Personal Sequestration, Business Liquidation, and Debt Counselling. We are not lenders or providers of credit. All services are offered in compliance with the National Credit Act (NCA) and South African Insolvency Law. Results vary depending on individual circumstances.