Financial crises can feel like an overwhelming storm.

Between mounting debt, lingering stress, and feelings of helplessness, it is easy to believe there is no way out.

But what if I told you there was a simple, actionable way to regain control—one small step at a time?

I used micro goals to get back on my feet and regain my financial stability during my Sequestration.

Micro goals are small, specific, and easily achievable steps that help you break down overwhelming challenges into manageable, bite-sized chunks.

They don’t require huge leaps forward all at once—instead, they focus on simple wins to help you rebuild confidence, motivation, and stability.

For me, micro goals were the magic that helped me regain my financial footing after going through Sequestration, and they can do the same for you.

Sequestration may sound daunting—and, to be fair, it is a significant financial step—but with the right mindset and strategies, you can move through it and toward financial stability.

Micro goals are a powerful tool in this process, as they help you take control, no matter how overwhelming things may seem right now.

Why Micro Goals Work

There is a reason micro goals have such transformational power.

Even in challenging situations like financial crises.

Studies show that accomplishing small goals releases dopamine, the “feel-good” brain chemical that boosts motivation and reinforces positive behaviors.

It is like giving your brain a high-five every time you achieve something, no matter how small.

Stacking these small wins creates momentum.

Making even the most significant goals feel achievable over time.

Instead of focusing on what feels impossible.

You will concentrate on the manageable tasks in front of you—boosting your confidence and providing a clear path forward.

From Overwhelmed to Empowered

When I faced Sequestration, the road ahead felt overwhelming and unclear.

My larger goals of financial stability and independence seemed miles away.

That is when I turned to micro goals.

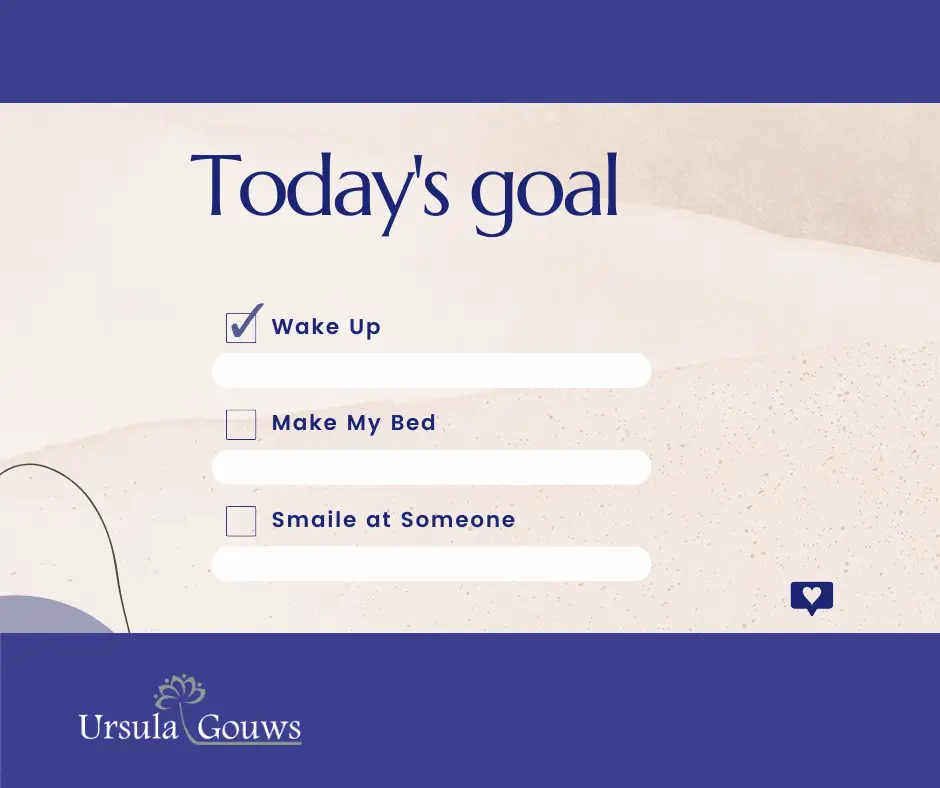

At my lowest, I started with the basics—getting up in the morning, making my bed, or even smiling at someone that day.

Yes, those were my goals at first.

They may seem insignificant, but they were manageable achievements when everything else in life felt out of control.

They gave me the motivation to tackle slightly bigger steps,.

Like tracking spending.

Setting up a simple budget,

And eventually addressing my debts head-on.

If you are in a similar place right now—dealing with debt or the emotional toll of financial struggles—micro-goals can help you find direction and comfort amidst the overwhelm.

How to Use Micro Goals to Rebuild Financial Stability

1. Set Short-Term Goals

Short-term goals are immediately achievable targets that boost your motivation and lay the groundwork for long-term stability.

Your first goals could be something as simple as:

- Tracking your expenses for one week.

- Avoiding one unnecessary purchase each day.

- Finding a free resource, such as a budgeting app or finance guide.

- To learn more about managing money.

The key is to focus on what is realistic today, not what your end goal looks like months from now.

You will gain the momentum needed to handle more significant challenges by achieving these smaller wins.

2. Create a Targeted Budget

A budget doesn’t have to be intimidating.

Start small.

Write down your immediate expenses—rent, utilities, food—and compare them to your income.

This doesn’t have to be perfect on day one, but knowing your basic numbers sets the stage for bigger financial decisions.

Your first micro goal could be as simple as setting aside 15 minutes to write down your spending.

It is not about perfection—it is about progress.

3. Break Down Debt into Smaller Steps

Huge debt can be paralyzing, so break it into smaller pieces.

Focus on paying off one credit card or making higher payments on a specific loan.

Or, if that feels too significant right now, set a micro goal to simply call your lender to better understand your options.

Remember, even making one phone call is progress.

4. Track Your Progress

Tracking progress is essential.

It helps you see how far you have come and reinforces a sense of accomplishment.

Create a simple checklist of your micro goals, or keep a journal of wins.

No matter how small they seem.

Whether it is reducing one unnecessary expense or completing a budgeting task.

Celebrate the effort you are making.

5. Celebrate Milestones

Did you finally pay off that small bill?

Congratulate yourself.

Did you take control of your daily spending?

That is worth celebrating, too!

Rewarding yourself doesn’t have to hurt your wallet—treat yourself to a relaxing walk, your favorite book, or a small indulgence within your budget.

The Benefits of Micro Goals

Using micro goals offers far-reaching benefits, especially if you’re navigating financial challenges:

Boosts Motivation and Confidence:

Small wins add up, helping you feel empowered to continue moving forward.

Reduces Overwhelm:

Breaking big goals into smaller pieces makes even the toughest challenges feel manageable.

Helps You Stay on Track:

Tracking micro goals gives you a sense of accomplishment and shows tangible progress.

Rebuilds Control:

Financial crises often make you feel like you have lost control over your life. Micro goals help you take it back, one step at a time.

Eases Stress and Anxiety:

Tackling small tasks reduces the emotional burden of facing a larger financial issue all at once.

Even during the darkest days of financial overwhelm, these small, actionable goals can light the way toward stability and security.

Final Thoughts

Sequestration or financial hardship is not easy—but it also doesn’t define your future.

With the right mindset and micro goals, you can take control and work toward your goals.

No matter where you are right now.

Start with micro goals.

Small steps like tracking expenses.

Creating a basic budget or reducing one minor expense can lead to significant changes over time.

Remember, every small win is progress, and every step forward—no matter how small—brings you closer to your larger goals.

If you are feeling overwhelmed, know this: you have got this.

Take it one micro goal at a time, and soon, you will look back and realize how far you have come.

What is your next step?

Start small.

Take 10 minutes today to write down your expenses or choose one financial action to focus on this week.

You have got this!

If you need additional guidance, don’t hesitate to contact our team, which is dedicated to helping individuals and families make sense of their debt.

Your financial future is worth investing in.

This blog was brought to you by Ursula Gouws.

This blog is for information purposes only and does not constitute legal or financial advice.

If you enjoyed this blog, check out more Debt Talk with Ursula on the Ursula Gouws Consulting Blog, or download our Freebies to help you on your journey to a new financial future.

I am a Debt Strategist. Let me help you find the ideal legal solution for your unique debt situation.

I understand that dealing with financial distress can bring about feelings of guilt and shame, and even depression.

Rest assured – working together, we will get you back on track, so your finances and dignity are fully restored.

If you need help finding the ideal legal solution for your debt, feel free to reach out with the contact form on my Website.